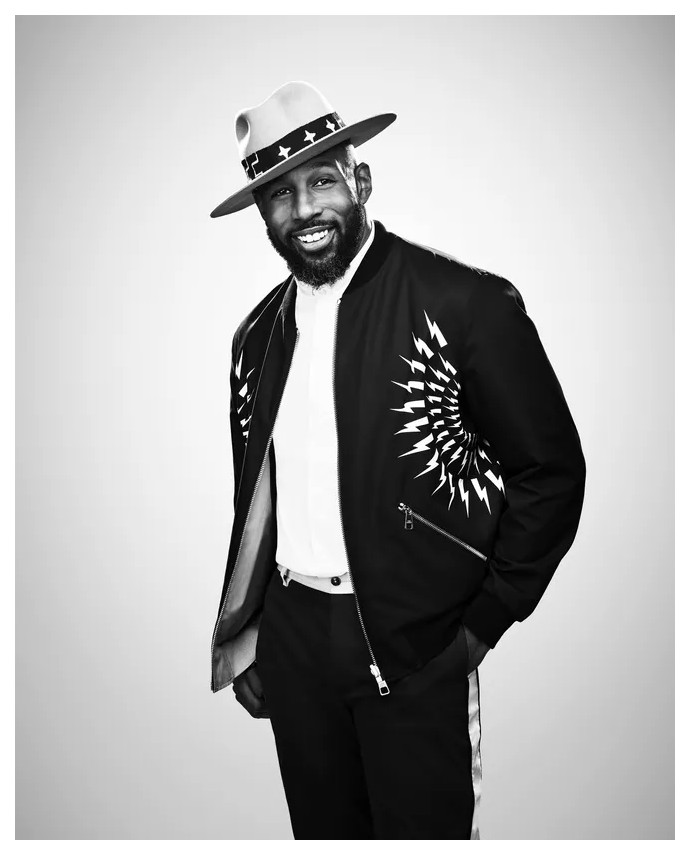

Stephen Laurel Boss, also known as “tWitch,” was an American DJ, hip-hop dancer, choreographer, television producer, and actor whose personality lit up the stage on So You Think You Can Dance and as a producer and frequent guest host on The Ellen Degeneres Show. Boss also co-hosted the TV show Disney’s Fairy Tale Weddings alongside his wife and fellow dancer, Allison Holker.

Boss and Holker shared a seemingly extremely happy life together in Los Angeles, California where they were raising their three children, ages 3, 7, and 14. Sadly, on December 13, 2022, Boss died by suicide at the age of 40. Boss’ death was a complete shock to fans and loved ones who reported the star seemed happy in the weeks leading up to his death.

Boss died without a Will or Trust in place, meaning his wife, Allison Holker, has the task of petitioning the California court system to release Boss’ share of their assets to her. Holker need to wait months or more before she can formally take possession of the property held in Boss’ name alone, including his share of his production company, royalties, and his personal investment account.

Unnecessary Court Involvement In a Time of Grief

In order to have access to her late husband’s assets, Holker had to make a public filing in the Los Angeles County Probate Court and must also prove she was legally married to Boss at the time of his death.

The court’s involvement will delay Holker’s ability to access her late husband’s assets – a hurdle no one wants to deal with in the wake of a devastating loss. In addition, the probate court process is entirely public, meaning that the specific assets Holker is trying to access are made part of the public record and available for anyone to read.

With court involvement, the timeline of steps that need to be taken is dictated by the court, and the process of proving your right to manage your loved one’s assets can feel like an unfair burden when there are so many other things to take care of during the death of a loved one.

This is not just a problem for the wealthy. Even if you own a modest estate at your death, your family will need to go through the probate court process to transfer ownership of your assets if you do not have an estate plan in place.

How to Prevent This From Happening to Your Loved Ones

When someone dies without an estate plan in place, the probate court’s involvement can be a lengthy and public affair. At a minimum, you can expect the probate process to last 6 months and oftentimes as long as 12 months or more. Court involvement in Boss’ passing could have been completely avoided if Boss and Holker had created a revocable living trust to hold their family’s assets. If they had, Holker would have had immediate access to all of the assets upon Boss’ death, eliminating the need to petition a court or wait for its approval before accessing the funds that rightly belong to her.

A Trust would have also kept the family’s finances private. With a Trust, only the person in charge of managing the Trust assets (the Trustee) and the Trust’s direct beneficiaries need to know how the assets in a Trust are used. There is also no court-imposed timeline on the Trustee for taking care of your final matters (with the exception of some tax elections), so your family can move at the pace that’s right for them when the time comes to put your final affairs in order.

The privacy that a trust provides also helps to eliminate potential family conflict because only the parties directly involved in the Trust will know what the Trust says. If issues between family members arise over the contents of the Trust, the Trust will lay out all of your wishes in detail, so that all family members are on the same page and understand your wishes for the ones you’ve left behind.

Guidance for You and the Ones You Love

Creating a revocable living Trust and other necessary estate planning documents Jacob & Greenfield ensures your loved ones have someone to turn to for guidance and support during times of uncertainty. No one expects the sudden loss of a loved one, but when it happens, even the simplest tasks can feel overwhelming, let alone the work involved to manage a deceased loved one’s affairs.

If you’re ready to start the estate planning process, contact us today for a no-cost 30-minute initial consultation.